What Is an IRS Installment Agreement?

7Newswire

28 Feb 2023, 14:57 GMT+10

It's that time of year again: time to pay the piper, as they say, and give back to old Uncle Sam. Tax time conjures mixed feelings for a lot of Americans, with some excited about the possibility of return and others worried about making ends meet.

If you're in the latter camp, it can be helpful to learn about the IRS installment agreement plan. If you have personal tax debt that you can't afford to pay all at once, this plan can help you to make the task at hand a bit easier.

It can help those struggling to buy a little more time and get a little more leniency when it comes to paying what they owe. What do you need to know about this kind of IRS payment plan? Read on and we'll walk you through the basics.

What is an IRS Installment Agreement?

If you need help with back taxes, you're certainly not alone. Hundreds of thousands of people have trouble affording their tax payments each year. In order to meet this problem, the Internal Revenue Service created installment plans.

An IRS Installment Agreement is a payment plan that allows taxpayers to pay their tax debts over time.

Taxpayers who owe less than $50,000 in taxes, penalties, and interest are eligible to set up an installment agreement. This is an alternative to paying the full amount due in a single payment or through a short-term extension.

Under an IRS Installment Agreement, taxpayers agree to make regular payments over an agreed-upon period, typically between three and six years.

The payments must be made on time and in full to avoid defaulting on the agreement. The amount of each payment depends on the amount of the tax debt, the length of the agreement, and the taxpayer's ability to pay.

Types of Installment Plans

The IRS has several types of installment agreements available, each with its own eligibility requirements and payment terms.

The most common types of installment agreements include:

Guaranteed Installment Agreement: This type of agreement is available to taxpayers who owe less than $10,000 and who have filed all required tax returns on time for the past five years. Under this agreement, the taxpayer can pay off their tax debt over a period of up to three years.

Streamlined Installment Agreement: This type of agreement is available to taxpayers who owe less than $50,000 and who can pay off their tax debt in full within six years or less. The taxpayer must agree to make monthly payments and to keep up with all future tax obligations.

Non-Streamlined Installment Agreement: This type of agreement is available to taxpayers who owe more than $50,000 or who need more than six years to pay off their tax debt. The taxpayer must provide financial information to the IRS, including income, expenses, and assets, and negotiate payment terms based on their ability to pay.

How to Set Up an IRS Installment Agreement

There are a few ways to set up an IRS Installment Agreement. The easiest way is to use the Online Payment Agreement (OPA) tool on the IRS website. This tool allows taxpayers to set up a payment plan in just a few minutes. To use the OPA tool, taxpayers will need:

- A copy of their most recently filed tax return

- The amount of their tax debt

- Their social security number or individual taxpayer identification number (ITIN)

- A valid email address

Taxpayers who owe more than $50,000 in taxes, penalties, and interest or who need a longer repayment period must submit a Form 9465, Installment Agreement Request, to the IRS.

This form requires taxpayers to provide detailed financial information, including their income, expenses, and assets.

What to Consider Before Setting Up an IRS Installment Agreement

Before setting up an IRS Installment Agreement, taxpayers should consider the following:

- Interest and Penalties: Taxpayers who set up an installment agreement will still owe interest and penalties on the unpaid balance. The interest rate is determined quarterly and is currently set at 3% per year, compounded daily. The penalty for late payment is 0.5% of the unpaid balance per month, up to a maximum of 25% of the total tax debt.

- Fees: The IRS charges a setup fee for installment agreements. The fee varies depending on how the agreement is set up. Taxpayers who set up an agreement online pay a lower fee than those who submit Form 9465.

- Impact on Credit Score: Taxpayers who set up an installment agreement may see a negative impact on their credit score. This is because the agreement is reported to credit agencies and may be viewed as a sign of financial distress.

- Default: Taxpayers who default on an installment agreement may face additional penalties and interest charges. They may also face collection actions, such as wage garnishment or bank levies.

Keeping these concerns in mind can help the average taxpayer from finding themselves in a worse financial position after taking on this kind of plan. You should completely understand what you're agreeing to before signing any paperwork with the IRS.

Managing Your Personal Tax Debt

An IRS Installment Agreement can be a useful tool for taxpayers who are unable to pay their tax debts in full.

However, it's important to consider the interest, penalties, fees, and impact on credit score before setting up an agreement. Taxpayers should also make every effort to make payments on time and in full to avoid defaulting on the agreement.

Have more questions about managing your taxes? More accounting needs you need help with? Keep scrolling our blog for more. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Mediterranean Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Mediterranean Times.

More InformationEurope

SectionTrump shows strong interest in Northern Ireland, says Deputy FM

BELFAST, Northern Ireland: U.S. President Donald Trump expressed strong interest in Northern Ireland during discussions at a high-profile...

Major coastal projects in Ireland get funding for climate adaptation

DUBLIN, Ireland: Three significant projects focused on marine conservation and climate change adaptation have received over 24 million...

Volkswagen to slash 1,600 jobs at Cariad by year-end

BERLIN, Germany: Volkswagen is set to cut 1,600 jobs at its Cariad software division by the end of the year, affecting nearly 30 percent...

Dublin unveils affordable housing plan for vacant Cabra site

DUBLIN, Ireland: Dublin City Council and Cluid Housing have unveiled plans to transform a vacant site in Cabra into an affordable rental...

Canada’s next PM Mark Carney to give up Ireland, UK citizenships

DUBLIN, Ireland: Mark Carney, Canada's incoming prime minister, has announced plans to renounce his Irish and British citizenships...

Ireland’s all-female crew begins Arctic trek for women’s heart health

DUBLIN, Ireland: An all-female crew is embarking on a challenging Arctic expedition to raise awareness and funds for women's heart...

International

SectionNTSB urges FAA to restrict helicopters near Reagan National Airport

WASHINGTON, D.C.: U.S. Transportation Secretary Sean Duffy announced that helicopters will be permanently banned from flying near Washington...

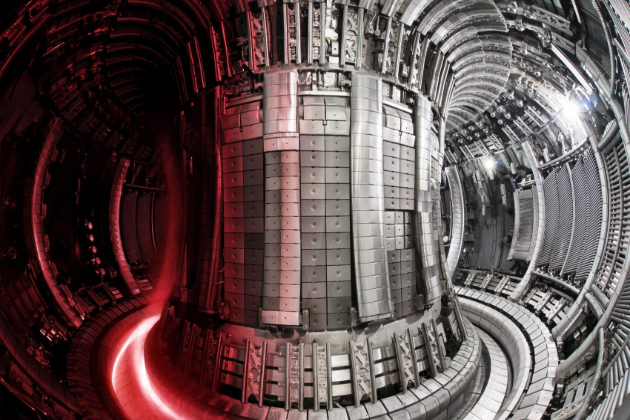

Virginia governor warns US must fast-track fusion or fall behind China

NEW YORK CITY, New York: The U.S. must accelerate its efforts to develop fusion energy or risk losing its edge to China, Virginia Governor...

China now dominates shipbuilding; US faces security risks

WASHINGTON, D.C.: In the past 20 years, China has become the world's top shipbuilder, producing more than half of all commercial ships....

New York fires 2,000 prison guards after wildcat strike

ALBANY, New York: New York fired over 2,000 prison guards this week for not returning to work after a weeks-long strike that disrupted...

China hits Canadian agriculture with tariffs in trade retaliation

BEIJING, China: China has announced new tariffs on Canadian agricultural and food products in retaliation for Canada's recent duties...

One dead, three injured as RV flips in Texas storm

ENNIS, Texas: A man died, and three of his family members were injured when their RV flipped several times during a strong storm at...